Part 3: Money-Making Machines

Those spending monsters have now been slayed like epic knights vanquishing a fire-breathing dragon, and it’s time to upgrade our wallets from pouches to overflowing treasure chests, baby! We’re talking turning our cash into money-making machines, transforming from savings slayers to debt demolition squads and investment newbies about to become future financial fortunetellers. These budgeting tips for young adults will help you get there!

Hey debt demolishers, here are the links to Part 1 and Part 2 of this series of articles.

1. From Budgeting Basics to Financial Feats: A Quick Recap

Before we embark further, if you need a refresher on the budgeting basics we discussed in our previous adventure, you need to read this article. Understanding those principles is key to making the most of the savings and investment strategies we’re about to explore.

2. Savings Slayers

Remember that crumpled fiver you stashed in your shoebox kingdom? Let’s make it work for you, comrade!

a. Automatic Savings A-Team

Forget manual saving, join the auto-pilot squad! These apps round up your purchases like digital Robin Hoods, stashing that spare change into a secret savings account. You won’t miss it, but future-you will be doing victory laps around your money mansion.

Now that your spare change is working for you, let’s take a small step further into the world of investing with micro-investments.

b. Micro-Investing Mania

Think stashing away savings is as dull as watching paint dry? Buckle up for a spin with micro-investing platforms – they’re about to turn that yawn into a cheer! Picture this: you’re treating yourself to a creamy latte for $3.50. The clever elves in the app round that up to a neat $4.00, and whoosh – the extra 50 cents magically flutters into a dazzling portfolio of investments. It’s like your daily coffee ritual is secretly planting golden beans in your very own financial garden.

And here’s the real kicker: those little coins, like unexpected treasures found under the couch cushions, start morphing into a spectacular stockpile. Imagine sipping your coffee while owning a teeny piece of tech giants like Apple, or having a slice of retail behemoths like Amazon with your sandwich. Those tiny investments? They’re set to rocket up like beanstalks on a growth spurt, all from the loose change in your pocket. Now, that’s turning pocket pennies into power plays!

Resources:

Now, brave fiscal adventurers, as we navigate the enchanted forests of micro-investing, let’s summon a couple of trusty allies to our side. These aren’t your ordinary sidekicks; they’re magical tools that transform the mundane into something marvelous!

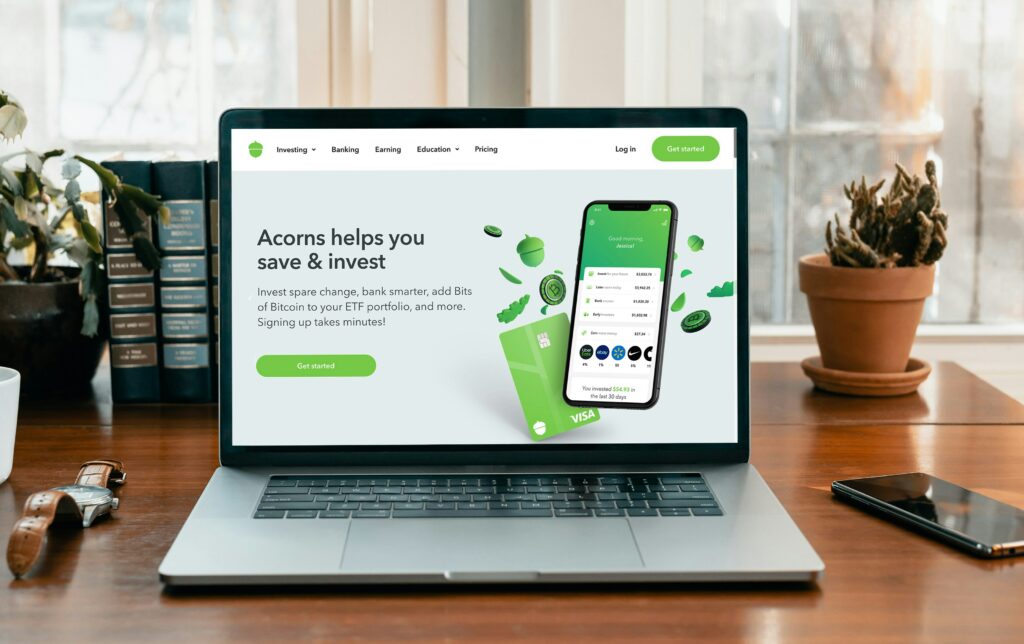

First up, meet Acorns, a valiant knight in the realm of micro-investing. With a swish and flick, it rounds up your purchases to the nearest dollar, turning spare change into a growing pile of treasure. Ready to see your pennies turn into mighty oaks? Acorns is your go-to for a spellbinding savings journey! The website link is here.

Next, let’s unveil Qapital, a wizard of whimsy in the world of savings. This clever concoction transforms your guilty pleasures into gold, stocking up your coffers every time you indulge. With Qapital, your dream quests aren’t just fantasies; they’re goals taking shape, one enchanting coin at a time. Tap into its magic for a savings adventure like no other! The Qapital website can be accessed here.

c. Compound Interest: Your Financial Fairy Tale

Imagine your savings as a magic beanstalk, growing taller not just from the beans you add, but also from the magical power of compound interest. Each bean sprouts more beans, growing your stash faster than a wizard’s spell!

As an example my fiscal fable friends, if you start with $1,000 and add $100 every month to an account that earns 5% annual interest compounded monthly, in 10 years, you’d have around $17,500 — that’s over $5,500 more than you would have saved without interest!

With these budgeting tips for young adults, you are setting the stage for a more robust financial future.

3. Crush Those Credit Card Critters

With your savings now growing steadily, it’s time to turn our attention to another crucial aspect of financial health: conquering debt.

Debt is the Hydra we all want to slay. But fear not, my financial fellowship! We’ve got weapons:

a. Snowball Strategy

Imagine you’re in an epic snowball fight with the debt dragon, lobbing snowballs left and right. This strategy is all about knocking out your tiniest debts first, gaining easy victories to boost your warrior spirit. Each debt you topple adds another snowball to your arsenal, making you even stronger for the next round.

Now, let’s dive into a real-world quest! Picture yourself juggling three tricky trolls: a credit card troll snarling with $2,000 at a fiery 18% interest, a car loan ogre grumbling with $8,000 at a mild 5%, and a hefty student loan giant, looming with $15,000 at a gentle 4%.

With the Snowball method, you go for the sneak attack on the smallest, the credit card troll, squashing it first for a morale-boosting victory. Then, you roll on to conquer the car loan ogre, and finally, you’re ready for the ultimate boss battle against the student loan giant. Victory by victory, you reclaim your financial kingdom from these menacing debt creatures!

b. Avalanche Attack

With the momentum gained from the Snowball Strategy, let’s escalate our debt-defeating tactics to the Avalanche Attack, targeting high-interest debts for even greater financial relief, saving you money in the long run. Think of it like an avalanche of savings burying the dragon under a mountain of financial freedom.

c. Consolidation Conqueror

Swamped by a buzzing horde of debt gnats? Fear not, for the mighty sword of debt consolidation is here! Imagine corralling all those pesky little debts into one giant, more tameable beast. This is like swapping a swarm of wild, tiny critters for one big, cuddly bear you can actually hug.

You’re essentially trading in your juggling act of credit card bills, car loans, and student debts for a single, sleek chariot of a loan – likely with a friendlier interest rate that doesn’t bite. It’s your financial wizardry wand to wave those multiple payment headaches goodbye, and potentially shrink the interest dragon’s fiery breath, too!

With this spell in your arsenal, you’re more than ready to dance with the debt dragon, lead it to a merry waltz right out of your financial kingdom, and reclaim your crown of fiscal freedom. Onward, brave money knight, to a land where your coffers are yours alone, and peace reigns in your budget kingdom!

4. From Stock Market Rookies to Future Financial Fortunes

Having tamed your debts, let’s channel your financial prowess into building wealth through smart investing.

Investing might sound like climbing Mount Doom, but it’s more like sending your money on epic quests for treasure (hopefully). Let’s keep it simple:

a. Index Funds

Think of these as your financial Noah’s Ark, sheltering a variety of investment animals (companies) under one roof. While this diversifies your risk – since not all stocks will sink or swim together – remember, even arks face storms. The market can be unpredictable, so these can smooth your journey through the ups and downs over time.

Look at it like this. Diving into an S&P 500 index fund is like getting a golden ticket to the grand ball of Wall Street. You’re not just betting on one corporate Cinderella – oh no, you’re waltzing with 500 of the biggest, most dazzling companies in the U.S. market! It’s like having a whole portfolio of financial fairy godmothers. Why? Because this diversification is your magic shield, protecting your treasure from the twists and turns of just one company’s story. You’re playing the grand game of investments with a full deck of aces!

b. Robo-Advisors

Once you’ve mastered the art of coin-taming with Index Funds, let’s leapfrog into the land of Robo-Advisors – your own digital Dumbledore of dollars and cents! Think of it as flipping on the autopilot in your financial spaceship. You just share your starry dreams and how much cosmic turbulence you can handle. Then, these robo-maestros orchestrate your investment symphony, picking the notes from a melody of index funds and ETFs. It’s like having a financial Merlin in your corner, crafting a spellbinding strategy for your treasure trove!

Just set your goals and risk level, and these savvy sidekicks will map out your investment journey, making sure you’re not just wandering like a lost soul through the economic wilderness.

c. Start Early, Chill, and Grow

The secret sauce of investing is … time. Plant your financial seeds, water them with a mixture of discipline and time, and reap the harvest of sweet, sweet loot.

Now that you’re familiar with these investment strategies, you’re on your way from being a stock market rookie to building your future financial fortune.

Alright, Fiscal Fable Friends, as we draw the curtains on our grand financial escapade, why not leap into action like the savvy money maestros you’re becoming? Let’s kickstart our treasure hunt with micro-investing! Zip on over to download a nifty app like Acorns or Qapital, and catapult your first coin into the investment realm – it could be just the spare change from your next snack run.

Think of it as planting your very own money tree from the tiniest seed. Every legendary tale starts with a single, bold stride, and your odyssey towards financial wizardry is no exception. So, strap on your financial capes, take that exhilarating leap, and soar into your newfound adventure, armed with all the cunning strategies and wisdom we’ve gathered. Onward, to financial wonders and beyond!

And now, as you stand at the threshold of your next great adventure, ask yourself: What dazzling financial goals will you conquer first? Follow these budgeting tips for young adults and the world of wealth is your playground – how will you make your mark?

P.S. Share your biggest budget fails in the comments below – gotta laugh before we slay, right? And who knows, you may be the cash flow cowboy (or cowgirl) picked out for the monthly prize – a copy of John Assaraf’s book, “Innercise: The New Science to Unlock Your Brain’s Hidden Power”.